Credit Direct Reviews | Loan UpTo $47,000

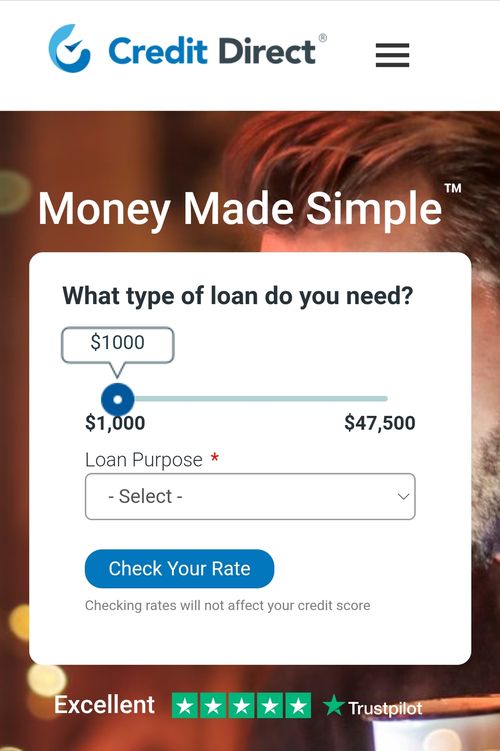

The Credit Direct marketplace offers personal loans directly to consumers as well as through its partner network. With competitive starting APRs and a prequalification process available online, the company offers competitive starting APRs.

In today’s article, we’ll give answers to all questions about creditdirect.com, which includes: Credit direct review, how does Credit direct work, how to loan on Credit direct, Credit direct Login, Credit direct sign up, Credit direct contact, is Credit direct legit or scam, and more.

By the end of this article our team, Tunnelgist.com is sure you must have arrived at a solid decision on if Credit direct legit, safe or scam, or maybe fake, as we assure every piece of information provided is authentic.

Without wasting more time, let’s get started with Credit direct Loan review.

Read More

Table of Contents

Credit Direct Review

In this Credit direct review, we’ll touch on various aspects of Credit direct review, which would help you know if this new make-money website can be trusted or fraudulent.

Also please note: This Credit direct Loan review doesn’t verify it all, so in the nearest future things might change and if anything goes wrong we won’t be held responsible for any reason.

What is Credit Direct Loan?

There is no credit check required to obtain unsecured personal loans from Credit Direct, and its range of loans ranges from $5,001 to $40,000. The Credit Direct network can help you get a loan directly from Credit Direct or through its partner networks if Credit Direct operates in your state. There may be more loan options available to you because of this, which is unusual for a lending marketplace.

How does Credit Direct Loan Works?

Credit Direct promises to send you personalized offers within minutes after you apply on its website (if you meet the pre-qualification criteria). Pre-qualification will not damage your credit score if you apply for it to check your potential offers. Nonetheless, if you decide to accept a pre-qualification offer, the lender may run a hard credit check, which could result in a slight drop in credit scores and different loan terms than what you pre-qualified for.

The annual percentage rate, or APR, is also competitive at Credit Direct. The company says the rates can vary based on your credit profile, but its upper APR range can be high.

You do not need a minimum credit score to qualify for the lowest APR, but you probably won’t qualify if your credit is shaky or you do not have credit history.

How to Apply for a loan on Credit Direct

Credit Direct performs a soft inquiry on your credit when you apply for prequalification on its website. You won’t see a change in your credit score as a result.

A potential loan offer will be sent to you if you prequalify. Upon reviewing your offers, if you decide to apply, you will have the option to do so in a formally formal application process. In case your lender performs a hard credit check afterward, your score may be lower by a few points.

If you want to complete your application, you’ll need some documents. Be prepared to submit them.

- Statements of two months’ bank accounts

- Pay stubs for one month

- W-2 form from the most recent year

- Identification card or driver’s license copy from a government agency

A loan approval will result in the funds being directly deposited into your bank account. It may take up to 24 hours before you receive your funds – but the lender notes that it usually takes between 48 and 72 hours.

Credit Direct Sign Up

To sign up on credit direct, you’ll be required to provide Statements of two months’ bank accounts, identity verification, email address and you are ready to go!

Credit Direct Login

For credit direct login, kindly use the link here to be redirected to creditdirect.com official website, then input the details you used while creating an account on the platform to complete the process.

Credit Direct Loan Interest Rate

An annual percentage rate (APR) of 3.5 percent is advertised by Credit Direct as its competitive starting rate. According to the company, its rates “can vary based on your credit profile,” so its upper APR range might be on the high side.

The lowest APR doesn’t require a minimum credit score, but if your credit is shaky or you have a little or no credit history, you are likely not to qualify.

Credit Direct Customer Service

You can direct Contact credit Direct using the contact us page on credit direct official website, or rather to ease your stress, click on this link to automatically reach the credit Direct Customer service page to lay your complain!

Is Credit Direct Legit?

Providing quick and easy personal loans up to $40000, Credit Direct offers low rates and quick approvals. Whether it’s for debt consolidation, unforeseen expenses, or any other reason, a personal loan can help.

With this, credit direct is obviously a legitimate loan provider at the moment. No flaws!

![Latest Clean Up Roblox Codes [month] [year]](https://tunnelgist.com/wp-content/uploads/2024/04/ROBLOX-CODES-_20240402_170517_0000-1.jpg)

![Anime rangers Codes [month] [year] – Roblox](https://tunnelgist.com/wp-content/uploads/2024/04/ROBLOX-CODES-_20240402_154736_0000.jpg)

![Asphalt 9 Codes [month] [year]](https://tunnelgist.com/wp-content/uploads/2024/03/WIKI_20240331_152102_0000.jpg)