Fig loans Reviews | Quick & Fast Loan Provider

If you are in need of an emergency loan to cover a large expense, Fig Loans may be the right option for you. However, these loans are only available in six states and come with high interest rates.

Fig loans review, Fig loans login, Fig loans registration, Fig loans referral, Fig loans customer service, Fig loans benefits, is Fig loans legit or scam, and more are all topics we cover in today’s article.

The Tunnelgist team, as we assure you all information provided is accurate, is confident you’ve come to a solid decision about Fig loans legit, safe, scam, or maybe fake by the end of this article.

We’ll begin with a review of Fig loans without wasting any more time.

Read More

Table of Contents

Fig loans Review

In this Fig loans review, we’ll touch on various aspects of Fig loans review, which would help you know if this new make-money website can be trusted or fraudulent.

Also please note: This Fig review doesn’t verify it all, so in the nearest future things might change and if anything goes wrong we won’t be held responsible for any reason.

What is Fig Loans?

Fig was founded as a partnership between United Way and Houston’s Chapter. Credit improvement is one of the company’s goals, according to its website.

A Fig Loan is referred to as a personal loan by Fig, and a credit-builder loan as a credit building loan. The three major consumer credit bureaus receive reports of both types of loans, so if you pay as agreed, you can build credit over time.

The following information will give you a better understanding of Fig loans.

How does Fig Loans Works?

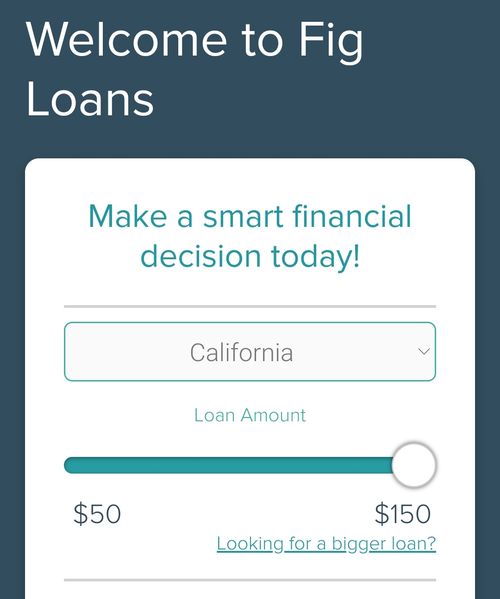

With loan terms of four months to six months, Fig’s personal loans – recommended for emergency needs – range from $300 to $750. Fig says it may give you a discount if you pay back your loan early.

Getting a secured credit card can help you build credit. Credit-builder loans are similar. It’s possible to get a credit-builder loan even if you don’t have credit or have bad credit. The Fig credit-builder loan involves putting money into a savings account for a year. All of the money you put into the account, also known as the principal, will be returned to you at the end of the year. On-time payments will build your credit history as long as you make them.

Fig says it will not consider credit scores when it analyzes your application, but it will consider other factors such as your income and outstanding loans. Fig loans are available only in the following states: Florida, Illinois, Missouri, Ohio, Texas and Utah.

How to Apply for a Loan On Fig Loans

Fig loans require you to live in one of the six states that it service, have a positive account balance at the time of application, and have at least three months of transaction history in your bank account. Paychecks must also be deposited directly into your bank account.

Your personal information will be required once you apply online.

- Name

- Birth date

- Phone number

- Address

- Email address

You may be able to get a loan at a lower APR by looking at other lenders before applying with Fig loans.

Fig Loans Sign Up

When signing up for fig loans, you will have to email address, phone number, address, birth date, and name.

Also, click on this link to get started immediately.

Fig Loans Login

For fig loans login, kindly use the link here to be redirected to fig loans website, then input the details you used while creating an account on the platform to complete the process.

Fig Loans Interest Rate

Fig personal loans tend to have high APRs that reach triple digits. You can get trapped in a cycle of debt if you are unable to repay Fig’s loans. Their APRs are extremely high. Your finances may suffer if you can’t pay back a Fig loan right away.

A credit-builder loan from FIG does not incur late fees. You will receive a refund of your principal and any interest owed on a past-due payment if you have a payment due that is about to be 30 days overdue. If your loan is closed instead of delinquent, Fig will report it as a closed account.

Fig Loans Customer Service

You can direct contact fig loan using the contact us page on fig loan official app, or rather to ease your stress, click on this link to automatically reach the fig loan Customer service page to lay your complain!

Fig loans Phone Number

This are the medium to contact fig loans phone number & email address. Click on this link to contact fig loans directly and view their number.

- Toll Free Number: 1-833-335-0855

Is Fig Loans Legit or Scam?

The Better Business Bureau does not rate Fig Loans. Fig Loans receives 4.9 stars on Trustpilot, with 95% of its customers rating the lender excellent. As of 2024, the Federal Trade Commission has received three complaints relating to Fitch’s personal loans.

Despite the flaws and wins, fig loans is still one of the most reliable loan out there!

Related

Conclusion

Thanks so much for reading this article till the end, that’s all for the Fig loan review, if there is more you want to add to this review, feel free to comment down below.

![Latest Clean Up Roblox Codes [month] [year]](https://tunnelgist.com/wp-content/uploads/2024/04/ROBLOX-CODES-_20240402_170517_0000-1.jpg)

![Anime rangers Codes [month] [year] – Roblox](https://tunnelgist.com/wp-content/uploads/2024/04/ROBLOX-CODES-_20240402_154736_0000.jpg)

![Asphalt 9 Codes [month] [year]](https://tunnelgist.com/wp-content/uploads/2024/03/WIKI_20240331_152102_0000.jpg)