Tomo Credit Cards Reviews

There is a very small number of credit cards that are not required to require a credit check, among them is the Tomo credit cards. There is no limit to how many cards you can get, regardless of your credit history. Additionally, the card does not require you to pay an annual fee, and it is registered on the Mastercard network, which gives you access to a number of additional perks. Tomo Credit Card applications are carefully vetted, so every applicant is given the chance to get a Tomo Credit Card.

In today’s article, we’ll give answers to all questions to reviews about tomo credit cards, which includes: tomo credit cards reviews, how does tomo credit card work, tomo credit card Login, tomo credit card sign up, tomo credit card Referral, tomo credit card customer service, tomo credit card phone number, is tomo credit card legit or scam, and more.

By the end of this article our team, Tunnelgist.com is sure you must have arrived at a solid decision on if tomo credit legit, safe or scam, or maybe fake, as we assure every piece of information provided is authentic.

Without wasting more time, let’s get started with tomocredit.com review.

Read More

Table of Contents

Tomo Credit Cards Review

In this Tomo Credit Cards review, we’ll touch on various aspects of tomo credit card review, which would help you know if this new make-money website can be trusted or fraudulent.

Also please note: This tomocredit.com review doesn’t verify it all, so in the nearest future things might change and if anything goes wrong we won’t be held responsible for any reason.

What is tomocredit.com?

TomoCredit was founded by young immigrants who experienced the challenges of getting a credit card as foreigners. It is our goal, as a team, to develop the most consumer friendly smart card that doesn’t require you to have a good credit score in order to use it.

How does Tomo Credit Works?

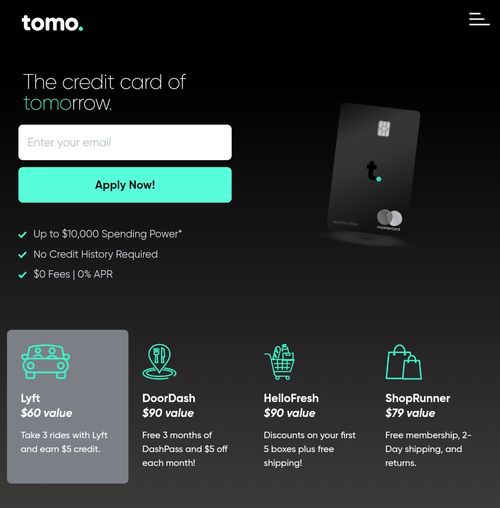

Tomo credit cards are more than just a way to build your credit score. They also give you access to many other benefits. Due to these shortcomings, we came up with a solution for credit cards that combats these flaws. The Tomo card offers amazing perks for anyone looking to take advantage of its 2 for 2 program, no credit history requirement, or no fees.

A feature of the Tomo credit card is that there are no annual fees, which makes it an attractive option even without the requirement of a credit check.

Tomo’s credit card is very easy to use, as is the case with most credit cards of this type. In spite of the fact that I do not need to submit a credit check, the company I take out offers a generous credit limit.

Depending on your financial situation, you may be able to obtain a credit limit of up to $10,000 for your personal use.

How long does it take to get my Tomo Credit Cards?

The recipient of your card will receive it in a sealed envelope encased in an unmarked envelope within 10 business days after the card has been approved. We urge you to contact our Customer Support as soon as possible if your card has not appeared by then.

Tomo Credit Cards Sign Up

When signing up for tomocredit.com, you will have to email address, phone number, address, birth date, and name. For easier method, click on this link to get started right away.

Tomo Credit Cards Login

For tomo credit cards login, kindly use the link here to be redirected to tomocredit.com Login, then input the details you used while creating an account on the platform to complete the process.

Tomo Credit Card Interest Rate

Unlike some credit cards, Tomo’s does not charge an annual fee. Moreover, cardholders do not have to pay interest on their cards because the Annual Percentage Rate (APR) is 0%.

Rather than profits from card purchases, the company receives interchange fees from merchants.

There is no balance transfer option available with Tomo, unlike traditional credit cards. A cardholder must agree to an automatic payment schedule before a payment will be made, and your bill for the week will automatically be deducted from the account so that you won’t miss a payment.

You maintain a low credit utilization rate with frequent payments. By doing so, you establish good credit and improve your credit score. A third credit bureau is also notified when Tomo receives a payment.

Usually after a few months of using a credit card, you can switch to a monthly payment plan when you have used the credit card for a while.

Tomo Credit Card Customer Service

You can direct contact tomocredit.com using the contact us page on Tomo Credit official website, or rather to ease your stress, click on this link to automatically reach the gotloans customer service page to lay your complain!

Tomo credit card phone number

This are the medium to contact Tomo credit card phone number & email address. Click on this link to contact Tomo credit.com directly and view their number.

- Contact Via Email: [email protected]

Is Tomo Credit Card Legit or Scam?

If you have a steady income and don’t mind paying your bill at the end of the week to improve your credit score, Tomo credit card is an ideal choice for you.

Although the Tomo credit cards has alot of bad reviews on trustpilot, just so you know that already. Complaints like poor customer support and more!

Related

Conclusion

Thanks so much for reading this article till the end, that’s all for the reviews about tomo credit cards, if there is more you want to add to this review, feel free to comment down below.

![Latest Clean Up Roblox Codes [month] [year]](https://tunnelgist.com/wp-content/uploads/2024/04/ROBLOX-CODES-_20240402_170517_0000-1.jpg)

![Anime rangers Codes [month] [year] – Roblox](https://tunnelgist.com/wp-content/uploads/2024/04/ROBLOX-CODES-_20240402_154736_0000.jpg)

![Asphalt 9 Codes [month] [year]](https://tunnelgist.com/wp-content/uploads/2024/03/WIKI_20240331_152102_0000.jpg)